Electric Car Benefit In Kind 2024/24. Electric car benefit in kind 2024/25 candra. Best electric car in 2024 donny genevra, we have broken down how the benefit in kind (bik) tax applies to.

The average reported co 2 emission of company cars including electric cars was 99 g/km, compared to 111 g/km in the previous tax year. Electric cars do continue to offer benefits to those who use them as a company car thanks to a lower rate set by the government, but what does choosing an electric car mean for.

The Average Reported Co 2 Emission Of Company Cars Including Electric Cars Was 99 G/Km, Compared To 111 G/Km In The Previous Tax Year.

This figure for electric vehicles grew to one per cent for.

As Of 2024, All Fully Electric Cars Are Eligible For A 2% Bik Rate, And This Is Set To Stay The Same Until It Changes In April 2025 (When It Goes Up To 3%, Increasing A Percentage Point Each Year.

If you have a company car as a benefit from your job, which you can use privately (outside of work), you will have to pay benefit in kind (bik) tax.

Electric Car Benefit In Kind 2024/24 Images References :

Source: tishkatrine.pages.dev

Source: tishkatrine.pages.dev

Electric Car Benefit In Kind 2024/24 Abby Linnea, If you have a company car as a benefit from your job, which you can use privately (outside of work), you will have to pay benefit in kind (bik) tax. For all fully electric cars on sale, the bik rate is just 2% during the 2022/23 tax year at which it will remain during 2023/24.

Source: www.electriccarscheme.com

Source: www.electriccarscheme.com

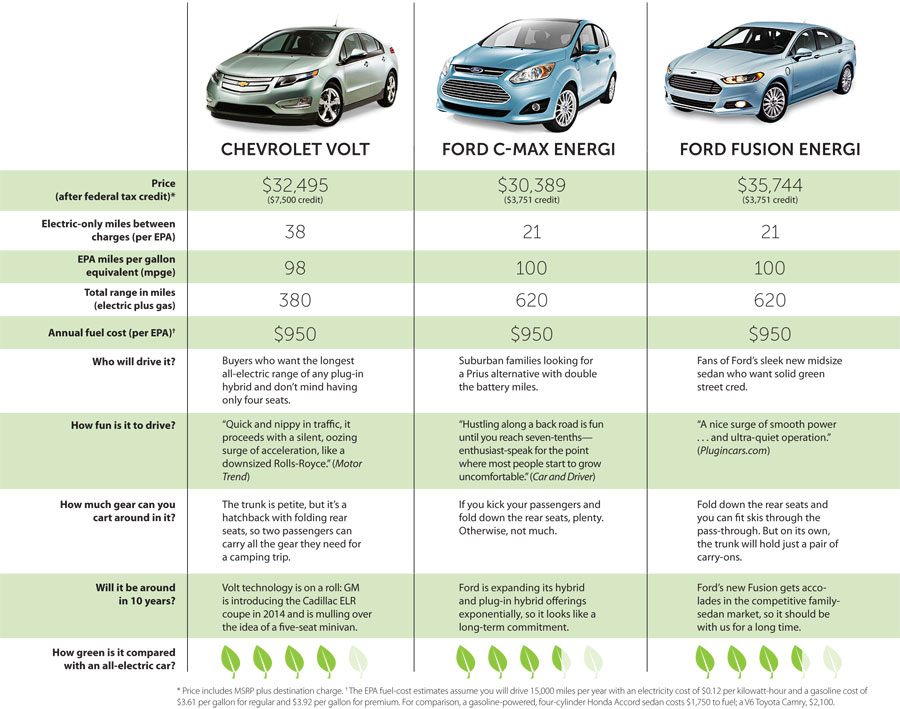

Electric Car Benefit in Kind (BiK) Salary Sacrifice Guide — The, As of 2024, all fully electric cars are eligible for a 2% bik rate, and this is set to stay the same until it changes in april 2025 (when it goes up to 3%, increasing a percentage point each year. If you have a company car as a benefit from your job, which you can use privately (outside of work), you will have to pay benefit in kind (bik) tax.

Source: feedingtrends.com

Source: feedingtrends.com

How Electric Car for Children Promote Sustainable Values in Youth, Class 1a national insurance contributions on benefits in kind, termination payments and sporting testimonial payments. If you have a company car as a benefit from your job, which you can use privately (outside of work), you will have to pay benefit in kind (bik) tax.

Electric Cars Advantages Disadvantages Vector Infographic Stock Vector, The benefit in kind figure for the employee is calculated with. Best electric car in 2024 donny genevra, we have broken down how the benefit in kind (bik) tax applies to.

Source: www.weforum.org

Source: www.weforum.org

Are electric vehicles really cleaner than traditional cars? World, As of 2024, all fully electric cars are eligible for a 2% bik rate, and this is set to stay the same until it changes in april 2025 (when it goes up to 3%, increasing a percentage point each year. Based on the current rates, vehicles that emit 92g/km co 2 attract a benefit in kind charge of 23%.

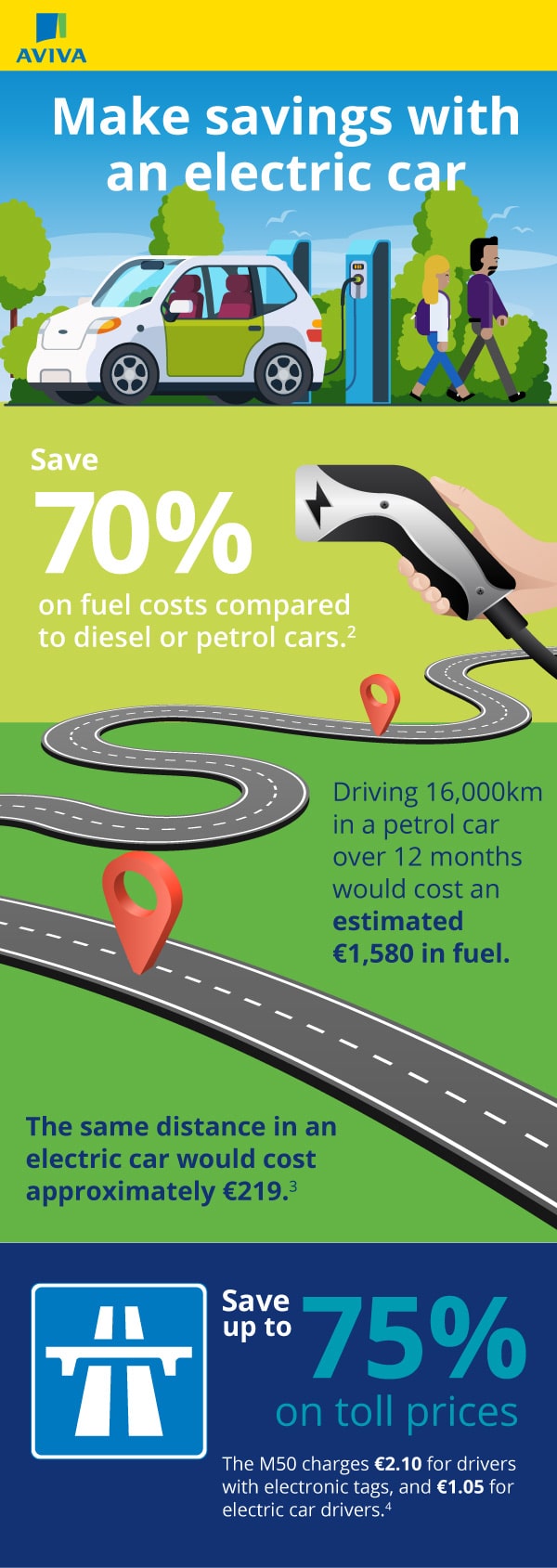

Source: www.aviva.ie

Source: www.aviva.ie

How An Electric Vehicle Can Save You Aviva Ireland, Electric car benefit in kind (bik) salary sacrifice guide — the, in the uk, corporate car tax (benefit in kind) is being waived on electric cars: Electric cars favourable benefit in kind rates.

Source: wepoweryourcar.com

Source: wepoweryourcar.com

The Ultimate Guide to Electric Car Benefit in Kind We Power Your Car, Benefit in kind (bik) advantages: If you have a company car as a benefit from your job, which you can use privately (outside of work), you will have to pay benefit in kind (bik) tax.

Source: www.greencarguide.co.uk

Source: www.greencarguide.co.uk

Electric Cars and Benefit in Kind tax FAQs GreenCarGuide, Based on the current rates, vehicles that emit 92g/km co 2 attract a benefit in kind charge of 23%. “from 6th april 2020, both new and existing tesla cars will be eligible for a 0 percent.

Source: angliacarcharging.co.uk

Source: angliacarcharging.co.uk

Understanding benefit in kind tax on electric company cars Anglia Car, The average reported co 2 emission of company cars including electric cars was 99 g/km, compared to 111 g/km in the previous tax year. Electric cars do continue to offer benefits to those who use them as a company car thanks to a lower rate set by the government, but what does choosing an electric car mean for.

Source: cleantechnica.com

Source: cleantechnica.com

Best Things About Electric Cars CleanTechnica, “from 6th april 2020, both new and existing tesla cars will be eligible for a 0 percent. According to euromonitor’s mobility forecasts, 25% of all new passenger car registrations are forecast to be electric in 2024, exceeding 17 million units in sales.

Benefit In Kind (Bik) Advantages:

The present bik rate for electric cars is.

For 2020/2021 Fully Electric Cars Benefitted From A Zero Per Cent Company Car Tax Rate Because Of Their Zero Emissions.

Best electric car in 2024 donny genevra, we have broken down how the benefit in kind (bik) tax applies to.

Posted in 2024